No business wants to lose its customers. In fact, several businesses allocate just as much effort toward maintaining their customers as to acquiring new ones. However, building customer loyalty is not a simple task. There comes a point in time when a customer simply stops doing business with you.

What happens then? Do you go out and find new customers? Do you try to analyze what could have gone wrong during their customer experience or buyer journey?

It’s important to understand customer churn and how it can affect business health. Let’s examine the top reasons for customer churn and what you can do to better understand high-risk customers. We’ll also explore several strategies you can employ to reduce this dreaded churn.

A Comprehensive Guide to Customer Churn:

What is Churn and How Does It Impact Your Business?

Customer churn, or customer attrition, is a metric that measures the rate of customers who stop doing business with you within a given time period. It’s one of the factors that can prevent your business from scaling up.

Customer loss isn’t just about losing sales and revenue. It brings with it a number of other repercussions that may potentially harm your business. You may lose sources of valuable feedback and insight, which are crucial for improvement. Your customer lifetime value can also suffer from just a single loss.

This is why it’s essential for businesses to look at customer churn and understand what’s causing it. Checking customer churn is dreaded by many businesses. However, evaluating it gives you a glimpse of your business’s health and customer retention performance.

Identifying Churn to Improve Customer Retention

It’s costly to acquire new clientele. In fact, it’s five times more expensive to acquire new customers than retaining your current ones. Not only is customer retention a more cost-effective strategy, but it has the potential to bring in more revenue. Even a small increase in customer retention can significantly raise your profit. That’s because returning customers tend to spend more, and they’re more likely to refer your business to their peers.

The bottom line is, losing customers can end up being costly for your business. Knowing what your current churn rate determines where your business currently stands. It also helps you find ways to reduce churn rate and come up with measures to sustain or increase customer retention rates instead.

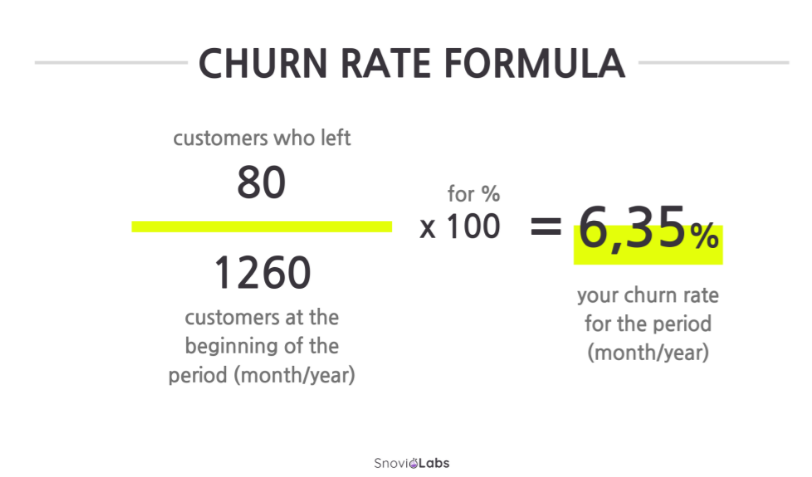

Calculating Churn Rate

To calculate churn rate, divide the number of customers you lost within a given period by the total number of customers you originally had during that same period. Multiply the result by 100 to get the percentage. You’ll have something that looks like this:

Source: snov.io

(Number of customers lost within a time period ÷ original number of customers during the same period) x 100 = Churn Rate

For example, you’re calculating churn rate for one quarter. During this period, you had 1000 customers. However, you lost 250 customers because of poor customer experience and relatively expensive prices. Your churn rate would be:

250 ÷ 1000 = 0.25

0.25 x 100 = 25%

The formula is adaptable, depending on what works best for you. You can also base your calculations on lost recurring business value or percentage.

Counting the total number of customers for a certain period can be challenging. You’d also be faced with determining when a churn actually happens. Does it take place when a customer cancels? Or do you have to wait for them to end their subscription or patronage before you can consider that they’ve churned? You’ll also have to consider multiple customer segments, each of which can have different churn rates.

A “good” churn rate is somewhere between 2% to 8%. Higher churn rates can:

⚙️ Negatively impact your bottom line, or your net income

⚙️ Prevent your growth

⚙️ Point to problems in company health

What Causes Customer Churn?

Now, we get to the heart of the problem: what causes customers to stop purchasing your products or using your services? Below are some of the common causes of customer churn:

? Customer service

Bad customer service is one of the most common causes of customer churn. If a customer has a bad experience with your business, it’s likely that they’ll stop buying your products or paying for your services. Businesses lose an estimated $75 billion annually because of poor customer service.

Why? Customers tend to remember bad experiences more than they do the good ones. Additionally, poor customer experience can lead to negative reviews, which are visible on your website or other review sites and online directories. Potential buyers look to reviews to make informed decisions. Coming across bad reviews of your business may potentially deter them from doing business with you.

Furthermore, there’s no denying that there’s a lot of competition out there. With the wealth of choices that cosnsumers now have, it’s easy for them to find alternatives to what you’re offering. It’s highly likely that the customers you lost will end up switching over to your competitors.

? Service rate or product price

Your prices can be a determining factor in whether or not a customer will do business with you. Chances are, if they find something more cost-effective, they might end up opting for that product or service instead.

? Poor user experience

A sub-par product or a service that has technical issues can drive away customers. No one wants to have a product that breaks down after a short while or something that’s difficult to use and requires a steep learning curve. If what you're offering delivers poor user experience, your customers might start to look for alternatives that would serve them better.

How to Spot High-Risk Customers

To prevent customer churn, you need to identify high-risk customers. They’re the ones who are at the brink of abandoning your business. Once you’re aware of who your at-risk customers are, you can create strategies for improving your relationship with them.

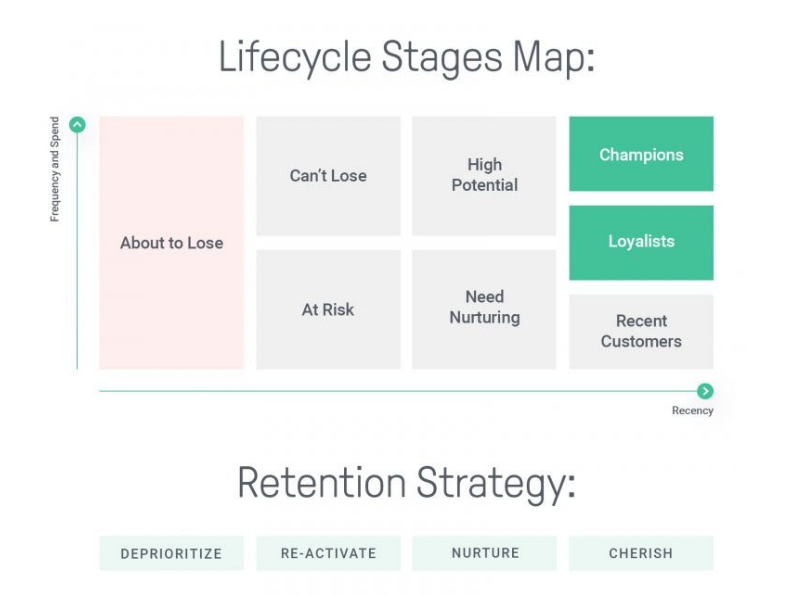

Source: omnisend.com

So, how do you spot high-risk customers? This is where leveraging data can help you get valuable insights.

Examine your online community

When was the last time you checked your online community? It’s a valuable resource that can help you see if customers have lodged indirect complaints or have shown their dissatisfaction with your product or service.

Check for angry comments and basic questions. The latter implies that a customer might not yet be familiar with a product. Consider this as an opportunity to educate or guide them and to create a more positive onboarding experience for them.

Check your support ticket data

A support ticket refers to the interaction that a customer has with a customer service representative. Having a low number of tickets may indicate that your customers aren’t engaged or have yet to use your product. Meanwhile, a high number indicates that you’re dealing with high-risk customers. This implies that they may be dissatisfied or are having a hard time with your product or service.

Check for any negative reviews or feedback

Negative reviews and complaints, whether direct or indirect, are a clear sign that a customer is unhappy, which makes them at risk. This can be an opportunity for you to reach out to them and address any issues they might have with your products or services.

Contract modification

Asking for modifications to your offer, in the form of discounts or changes to their subscription contract, may be considered as risk factors for customer churn. It’s highly likely that, at this point, they’re considering other providers. Talk to them and find out why they’re asking for a discount or why they want to have their contract amended. Again, you can view this as an opportunity to educate your customers about your product and the value it brings.

Track your website activity

Your customer’s website activity can be an indicator that they’re at risk of churning. You’d want to look out for activity that shows they want to deactivate or cancel their subscription. If you spot customers who are inactive, this implies they’re not engaged. Reach out to them and ask them if they’re having issues with your product.

Once you’ve determined common customer pain points, discuss them with your team and come up with a solution to prevent your customers from churning.

Simply put, high-risk customers are those who have had a bad experience with or are unhappy or unenthusiastic about what you’re offering. They’ve yet to see the value of your product or how it can potentially address their pain points. They may also be the ones trying to reach out to you but were made to feel like their opinions don’t count.

3 Things You Can Do to Understand High-Risk Customers

It can be challenging to prevent your high-risk customers from abandoning your business, but by trying to understand customers who have churned, you can create a richer experience for your current and future customers.

? Find out what happens after a customer leaves

A customer who has left is still a valuable source of data. Check to see if there’s a trend among customers who left. Did they leave because a competitor has better prices? Were they looking for other options? Often, the data can help you determine the areas you need to work on to improve customer retention rates.

? Determine what the ideal buyer journey is

Knowing what your customer’s ideal buyer’s journey is can help you determine at which point they deviated from it. Find ways to engage them at various points of their journey. By keeping them engaged throughout, you’re reducing the risk of them leaving you for the competition.

? Get feedback from customers who churned

When a customer leaves, don’t be afraid to ask them for feedback. Find out why they decided to leave and who they’re currently doing business with. Yes, this can be a painful process, but their feedback can help you identify problem areas, which you can address by making improvements.

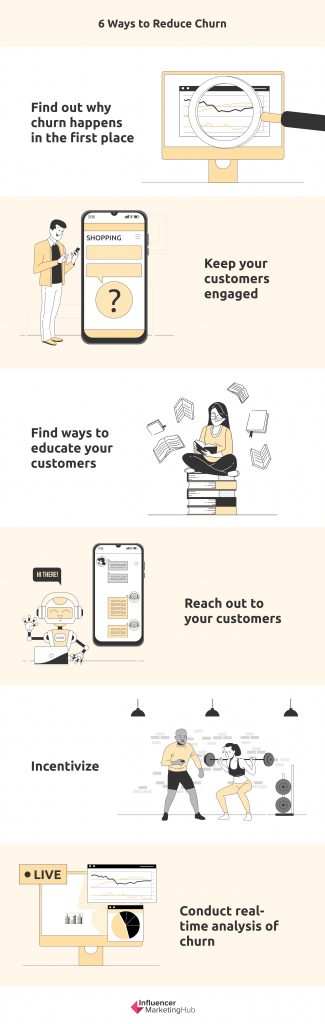

6 Ways to Reduce Churn

Yes, churn is a pressing issue that businesses constantly face but there are ways to reduce it. One way to prevent it is by determining and targeting who your high-risk customers are. Here are some of the steps you can take to tackle churn:

? Find out why churn happens in the first place

The best way to analyze churn is to identify the reason why your client stopped buying your product or service. Talk to your customer and ask them why they left. While you can conduct exit surveys, opting to go for an actual conversion helps you get to the heart of the matter faster.

? Keep your customers engaged

Being proactive in engaging with your customers is one of the best ways to prevent churn. Give them value-adding content across multiple channels that highlight the features or benefits of your product. Offer discounts or start a newsletter from which they can find regular product or service updates. Maintain their interest and curiosity. Give them a reason to keep coming back.

? Find ways to educate your customers

One of the most common reasons why a customer leaves is because they don’t know how to use your product or they don’t see its value. Use this as an opportunity to educate your customers, allowing them to see your product’s full potential and how it can benefit them. There are many ways to educate your clients. You can share tutorials, demos, or training. The key here is to make these materials easily accessible to them.

? Reach out to your customers

Be proactive in communicating with your clients. Engage them as soon as they show interest, and don’t wait until an issue crops up before you reach out to them. Give them multiple avenues for giving their honest feedback and make it easy for them to reach you. Make them feel that they’re seen and heard.

? Incentivize

Offering incentives can encourage clients to stay. Whether you’re offering a promo, a discount, or a rewards program, incentives help communicate to customers that you value them.

? Conduct real-time analysis of churn

Don’t wait until it’s too late before you analyze churn. When is it too late? It’s when you wait for a customer to leave before you do anything. The best time to analyze churn is before it happens so you can plan ahead and take the necessary measures for preventing customers from leaving.

Final Thoughts

Customer churn happens to every business. It can be debilitating and seriously affect your business’s growth. However, it’s possible to reduce your churn rate.

The key here is to leverage data, which includes knowing what your churn rate is and identifying who your at-risk customers are. By actively engaging your customers, educating them about your product and its value, and understanding their behavior, you can craft a strategy that lets you build better relationships with them.

Frequently Asked Questions

Are there other churn rates I need to know of?

Yes, the annual churn rate and the monthly churn rate. The former refers to the rate of customers that a business has lost over the span of one year. The latter is your churn rate for the month.

How can I track churn rate?

You can use a spreadsheet or a third-party software to track your churn rate.

What is customer attrition?

Customer attrition is just another term for customer churn.

What’s the best way to identify customer churn?

One of the best things you can do is to determine what you think counts as churn. Does churn happen when a customer ends their subscription or does it take place when they don’t return for a repeat purchase? Once you’ve determined what your definition of churn is, you can create metrics to identify and target high-risk customers.

What role does customer onboarding play in reducing churn?

The customer onboarding experience is crucial to retaining your customers. Keep in mind that not all customers know how to use your product at the get go. A customer who has trouble adopting your product is likely to lose interest and this could cause them to churn. Make the transition easier for them by having a streamlined and personalized onboarding process that lets you communicate your product’s value to them.