BNPL has attracted over $7.5B in funding across 100+ fintechs, indicating strong market confidence in the retail financing space. With a global market valuation of over $90.5B and a predicted CAGR of 45.7% from 2021 to 2030, BNPL is revolutionising the retail financing space by raising the bar on payment flexibility and creating innovative channels for merchants to generate repeat business.

Buy Now, Pay Later (BNPL) – Where Are We?:

What it is

Buy Now Pay Later, also known as BNPL, is a mode of unsecured, Point-of-Sale (POS) financing that permits consumers to make purchases that they then pay for over time. It is a short-term, no-interest consumer credit product that has become nearly ubiquitous at the point of purchase online and, increasingly, in brick-and-mortar stores. “Buy now, pay later is the new version of the old layaway plan, but with modern, faster twists where the consumer gets the product immediately but gets the debt immediately too,” said CFPB Director Rohit Chopra. Customers can split the purchase bill into smaller installments, usually at zero interest when compared to using a credit card. Thanks to the widespread BNPL adoption by consumers and merchants, the market benefits from the ability to afford more without having to spend excessively at the time of transaction.

Source: mckinsey.com

Source: mckinsey.com

Who uses BNPL?

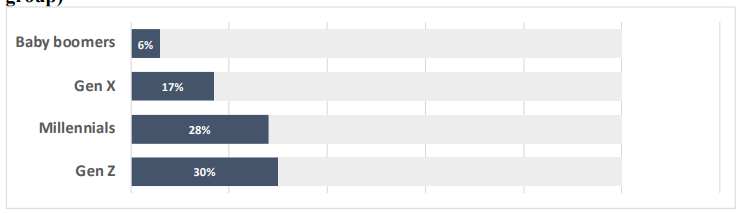

Use of BNPL witnessed substantial growth across all generation groups from 2019 to 2021. Yet, it has the highest penetration among Millennial and Gen Z consumers.

Figure: Share of survey respondents who used BNPL in Jan. 2022 (by generation group) - source: hks.harvard.edu

Since they are tech savvy, consumers belonging to the Millenial and Gen Z cohorts are early adopters of app-based services in general and the aggregation of BNPL uptake in such young consumers is fairly predictable. What raises eyebrows is the poor financial maturity that consumers in this younger age group typically possess.

TransUnion, one of the major consumer credit reporting agencies in the US, has studied and published data on BNPL consumer trends. TransUnion’s 2021 analysis of over 4 million BNPL users found that, compared with the average consumer, BNPL consumers:

- Are younger (77% between 18 and 50)

- Have worse credit ratings (69% are subprime or near prime)

- Are more likely to be derogatory (90+ days past due on payments generally)

- Are more likely to be seeking credit (have higher volume of inquiries for credit)

While BNPL users do generally have access to some forms of credit, they have lower-than-average access to the type of credit they actually need: bankcards and retail cards. For many consumers in this category, BNPL products fill the gap.

Why Do People Use BNPL?

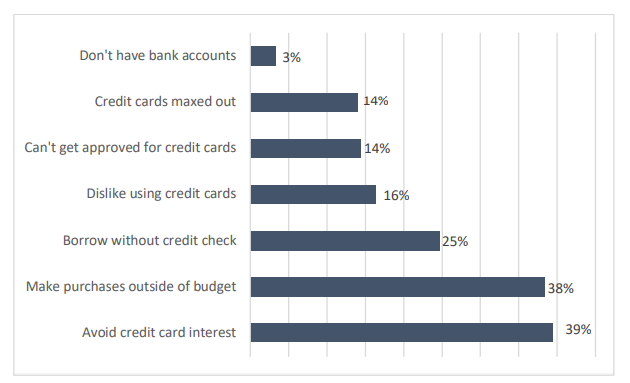

Based on a survey conducted by Insider Intelligence in Feb 2022, the most commonly cited reasons for BNPL use were avoidance of credit card interest (39% of users) and making purchases that “wouldn’t fit in [their] budget” (38% of users). Lack of credit and financial distress accounted for a significant portion of users’ BNPL engagement rationale.

Figure: Reasons why consumers opt for BNPL products - source: hks.harvard.edu

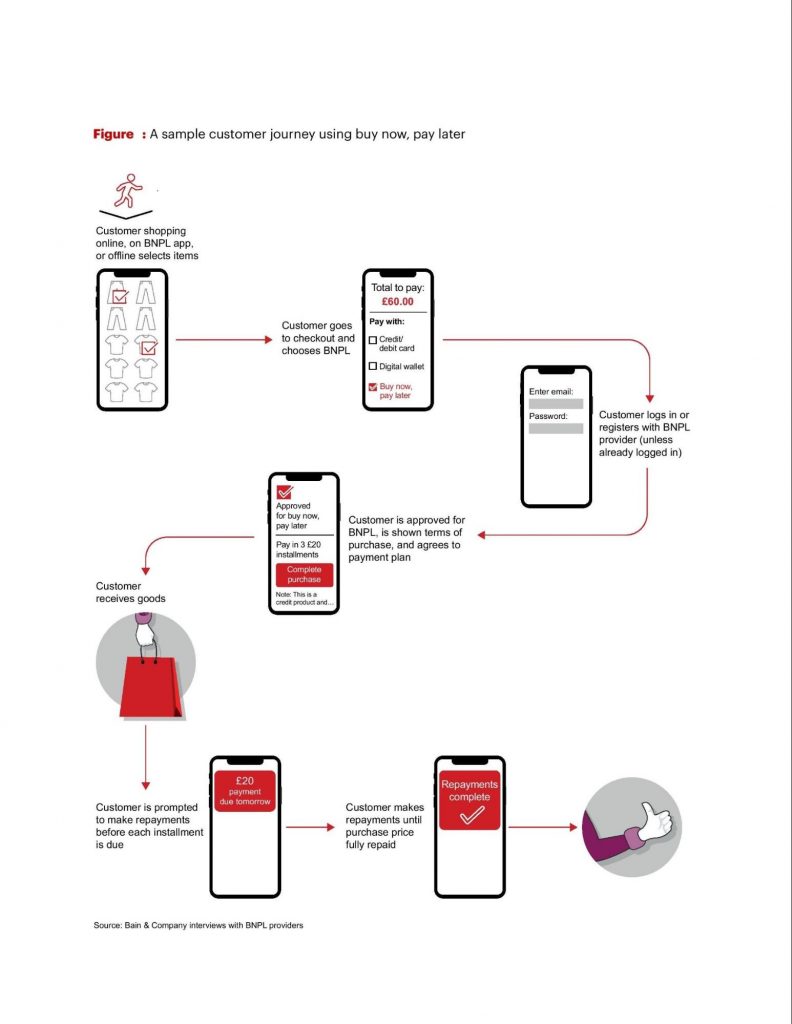

How it works

Most BNPL products are tailored for online shopping experiences and target the tech-savvy younger generation.

Source: bain.com

BNPL vs Credit Cards – A comparison

Both BNPL providers and credit cards facilitate deferred payment for purchases of goods and services. When using credit cards, however, the consumer bears the interest on the purchase amount based on the terms and conditions of the card. In many instances, the interest cost imposed by credit cards are quite high. If repayments are missed, the amounts quickly add up. On the other hand, BNPL providers generally provide more attractive rates compared to credit cards and this has been a vital factor in the rising popularity of BNPL.

When a consumer applies for a credit card, a hard inquiry into their credit history is typically made, harming their credit score. Most BNPL companies conduct soft credit checks, which typically won't affect the credit score. In this way, BNPL can be a less risky payment option for customers.

At the aggregate level, typical BNPL balances are about eight times smaller than credit card balances (approximately $125 vs $1,100). This is likely due to the basic attributes of BNPL products viz shorter tenures and more limited uses.

Where it works

Conventional POS financing usually entails a hard credit check, higher monthly payments and the scrutiny of sensitive documentation, such as a social security number, for verification. They also require the consumer to possess a satisfactory credit score and be able to afford the repayments. BNPL has evolved from this traditional model of POS financing, helping to overcome such obstacles for today's consumers and increasing their purchasing power. The crucial differentiator here is the ticket size and the category of the product purchased. As a result, multiple ways of implementing BNPL solutions to customers have emerged.

Offline: No doubt, BNPL has leveraged the increasing penetration and adoption of electronic payments services. However its expansion would be limited if restricted to digital platforms alone. Newer POS terminals are equipped with the technology required to offer BNPL to in-store retail customers and are leveraging their market penetration to drive BNPL into the hands of merchants and consumers alike. In 2020, Verifone began offering Klarna's BNPL options to in-store retail customers in the US. In the APAC region, AsiaPay's partnership with Atome combines the latter's BNPL services with AsiaPay's expansive POS network to offer both offline and online BNPL services.

BNPL's growth is remarkable, but point-of-sale financing has increased consumer purchasing power for years. In 2018, POS financing was touted as a $1.8 trillion opportunity, most notably due to the increase of millennials' and Gen-Z's discretionary income and their deviation from the buying norms of previous generations.

Who benefits from BNPL?

In a typical BNPL scenario, a merchant provides goods or services to the consumer at the prevailing rate. Instead of the consumer paying the total balance for their purchase, the BNPL provider enters into an agreement with both the consumer and the merchant to satisfy both sides. The provider then compensates the merchant for the cost of the goods or services sold, while the merchant pays a commission fee for each purchase made using the BNPL provider's services. In utilizing the provider's services, the consumer agrees to repay the amount paid by the provid er over the stipulated period.

Consumers

While BNPL grows in popularity as a payment solution, it is important to understand why consumers like BNPL and how they can be best positioned to add value to all the stakeholders.

The declining use of credit cards

Since the start of the COVID-19 pandemic, consumers have been slowly moving away from the dominance of traditional credit cards, with factors such as high-interest rates, declining credit limits and poorly implemented rewards programs aggravating the issue. The declining use of credit cards presents an opportunity for alternative payment methods such as Buy Now, Pay Later.

Affordability

Unlike credit cards — which make their money from interest rates and late fees — BNPL providers offer a more affordable payment option since they typically have limited fees and interest rates.

Convenience and flexibility

For consumers who are wary of credit cards and typically don’t carry cash, BNPL offers a convenient, flexible payment option. Payment approval is instantaneous and if you’re looking to order items for a later date, BNPL works as well, ensuring on-time delivery without any payment hassles or forgetfulness.

Retailers

Merchants see value in BNPL products, as most enhance cart conversion, increase average order value, and attract new, younger consumers to their platforms. However, the incremental impact of such solutions varies by merchant size and category.

Regulatory view

In the US, there are currently no formal standards of disclosures to consumers at the POS regarding fees, amounts owed, credit reporting, payments or due dates, for most BNPL products. This period of regulatory uncertainty provides BNPL companies opportunities to establish and expand rapidly, without being bogged down by some of the administrative burdens of adhering to consumer protection regulations. While credit card companies are required to maintain large customer support teams to resolve charge disputes, BNPL companies, as installment loan providers, are currently exempt from this obligation.

Regulatory responses to protect consumers are already underway in some markets around the world. For example, all the rights and protections afforded to regulated forms of credit in the UK were extended to BNPL products by the Financial Conduct Authority. Following a Senate inquiry, the Australian Finance Industry Association has developed a BNPL code of conduct.

Top 15 BNPL-enabled eCommerce retailers in the US

Etsy

Brooklyn, NY-headquartered Etsy is the top-ranked online retailer in the US, with estimated annual web sales north of $5B. Etsy is a global marketplace for unique and creative goods such as handcrafted pieces and vintage treasures and adopts Klarna’s BNPL payment gateway.

Target

Target is a general merchandise retailer in the US with 75% of the population living within 10 miles of one of its stores across the country. This Minneapolis, MN-based company has an estimated annual web sales of over $5B and deploys BNPL payment technologies Affirm and Sezzle.

Crunchyroll

Boasting 120M users and 5M subscribers worldwide, this Burbank, CA-based distributor, publisher, production and licensing company focuses on streaming anime, manga, and dorama to a passionate community of fans around the world. With 8.8M unique monthly visitors and a Website Traffic Rank of 354, Crunchyroll caters to its customers using the Sezzle BNPL payment solution.

Lenovo

Lenovo is renowned for its extensive portfolio of PCs and tablets, monitors, accessories, smartphones, smart home and smart collaboration solutions around the world. The Morrisville, NC-headquartered company has annual web sales in the range of $1B - $5B and processes BNPL payments through Afterpay.

Mercari

Mercari is a marketplace app, which allows users to buy and sell items quickly from their smartphones. The estimated annual web sales of this new-age company with a Website Traffic Rank of 583 is over $5B. Zip is the BNPL payment technology used by Mercari.

DoorDash

DoorDash is a technology company that connects people with the best of neighbourhood restaurants, convenience stores, pet stores, grocery stores across the US, Canada, Australia, Japan and Germany. Around 5.4M unique visitors get introduced to its website every month where annual web sales is estimated to be in the range of $1B to $5B. The company uses Pace technology for its BNPL solution.

Uniqlo

Uniqlo is the world’s No.2 apparel manufacturer and retailer based on market capitalisation. Its estimated annual web sales of $1B to $5B comes from the 4.5M unique visitors to its website that deploys Afterpay as the BNPL partner.

Bed Bath and Beyond

Union, NJ-headquartered Bed Bath and Beyond is a unique destination for home goods, offering a wide array of top-quality items in bedding, bath, home décor, furniture, beauty & fitness, luggage and more. Bed Bath and Beyond uses Afterpay as the BNPL payment solution and clocks annual web sales of $1B to $5B.

GameStop

GameStop is an American video game, consumer electronics and gaming merchandise retailer. The company is headquartered in Grapevine, Texas and is the largest video game retailer worldwide. Claiming a Web Traffic Rank of 1964 and about 10M unique visitors to its website every month, GameStop’s estimated annual web sales is in the region of $500M to $1B. GameStop accepts BNPL payments through its partner Zip.

Michaels

Michaels is an Irving, TX-based retailer of general merchandise. Michaels has a Website Traffic Rank of 2901 and around 2M unique visitors to its website every month, who contribute to its estimated annual web sales of $500M to $1B. Customers at checkout counter are provided with BNPL solutions, powered by Affirm.

Fitbit

Fitbit is based in San Francisco, CA and is an online retailer of technology solutions in the health and fitness space. The 2.6M unique monthly visitors to the company’s website support its approximate annual web sales of $250M to $500M.

J Crew

New York, NY-based J Crew is a boutique apparel retailer garnering about 1.6M unique visitors to its website ranked at 3600. J Crew makes an estimated annual web sales in the range of $500M to $1B and Afterpay is the BNPL payment platform.

Barstool Sports

An online retailer of casual and sports wear goods, Barstool Sports is yet another company based out of New York, NY. This niche merchant clocks annual web sales in the range of $10M to $25M and uses Sezzle to accept BNPL payments.

Walmart

This legendary brand based in San Bruno, CA has a very strong physical presence across the US. Its online presence is fairly modest though: unique monthly visits to its website in the range of 2.4M, annual web sales being about $50M to $100M and a website traffic rank of around 3800. Walmart has partnered with Pace for providing its customers BNPL options.

Ralph Lauren

Ralph Lauren is a global leader in the design, marketing and distribution of premium lifestyle products. Headquartered in the fashion capital of New York, NY, its website garners around 0.3M unique visitors every month; yet, its estimated annual web sales is in the region of $500M – 1B. Klarna is Ralph Lauren’s BNPL gateway partner.