NFTs are rapidly becoming popular in the creative and gaming worlds. They are particularly beloved by those who have entered the crypto-world and already understand the workings of cryptocurrencies like Bitcoin and Ethereum. Modern-day artists, in particular, have found a whole new audience for digital art backed by NFTs.

As we found in our The State of the Creator Economy report, creators can use NFTs as ways to recognize achievements and otherwise highlight their relationship with their fans. They also provide a means of equity ownership for creators, with NFTs being unique digital items like collectibles, artworks, badges, and stickers. We have even discovered a surprisingly large number of NFT marketplaces where creators can sell their NFTs.

But, like many new things in this digital age, the average person is still uncertain about NFTs, and indeed may never have heard of them at all. So, what is an NFT, and how do they work?

What is an NFT, and How do They Work?:

What is an NFT?

Source:freepik.com

NFT stands for non-fungible token, a type of unique digital asset whose ownership is managed on a blockchain. Although most NFTs are inherently digital, you can use NFTs to track physical assets as well. Typical examples of NFTs include digital artworks, in-game items in videogames, unique collectibles, and even some domain names.

The essential feature of any NFT is that it is unique. Although a creator can choose to have near-multiple identical copies of an NFT, each has to be distinguishable somehow.

The original NFTs had their ownership managed on the Ethereum network (a competitor to the better-known Bitcoins.) However, there are now multiple blockchain standards that those wishing to mine (create) NFTs can use. At its heart, an NFT is just a digital representation of something unique that uses a smart contract platform to prove that it is genuine.

Note that not everything recorded on blockchains are NFTs. Remember that NF stands for non-fungible. Fungible tokens are items that are alike, e.g., one Bitcoin is the same as another Bitcoin. Old-style currency is also fungible – one $1 note is the same as another $1 note. Indeed $1 in the bank is the same as that $1 note.

We have had non-fungible digital assets for years. Domain names are a classic example – every domain name is different. When you buy a domain name, you have purchased the ownership of that specific URL. If you purchase an event ticket online, you are buying the right to a particular seat at a specific time. For some time, you have been able to make in-app purchases in games. For example, if you are a Fortnite player, you might have to pay to purchase a particular skin.

The problem with many of these digital assets is that they can be difficult to resell. You will find some secondary markets; for instance, you might be able to sell your event ticket online. However, it is much harder to find a market to sell your Fortnite skin, for instance. The arrival of NFTs has made it much easier to establish ownership and find a ready market to sell your digital assets. The digital information included for one NFT will always differ from that for another, even if the two NFTs look similar on the surface.

How do NFTs Work?

It is best to think of a blockchain as a special kind of database that stores data in groups (known as blocks), digitally chained together. Each block of data has a limited capacity, and when that capacity becomes full, additional data goes into another block, chained to the original. Ultimately, all the chained blocks create a long history that remains permanent. So, for example, every time an NFT sells, the new ownership details get added to a new chain in the blockchain, ensuring that the history of that NFT remains intact and ownership is secure.

NFTs have one significant advantage: by being backed by something already known as finance-related (for example, Ethereum), there are existing mechanisms for issuing, recording, and trading them. They have many of the same advantages that crypto currencies have. They are borderless and comparatively easy to create and then to transfer ownership.

Each NFT token has a unique identifier. They are not directly interchangeable with other tokens. Each has an identified owner and can be bought and sold on a relevant blockchain marketplace.

Creators set the level of scarcity for an NFT. In some cases, the creator of an NFT may choose to mine multiple replicas. For example, if you mine NFTs as tickets to an event, each ticket will essentially be identical, apart from the seat number and the event's date/time. You could, however, mint tickets at different levels for different types of seats. Or you could choose to make each ticket wholly different and a collector's item. Each distinct NFT, however, has a unique identifier.

Some NFTs are even programmed to automatically pay royalties to their creator each time they sell.

NFT Standards

One advantage of NFTs over other digital assets is that they follow standards. In the past, each creator of a digital asset would use their own systems, making them incompatible outside their own digital world. For instance, a game developer would set up a stand-alone in-game shop, where people could purchase avatars and other digital gaming assets but make it a closed environment. These digital assets wouldn't exist outside the game environment, and there would be no possibility of a resale market.

There are now a series of blockchain, internet, and content standards that NFTs follow. There are still variations, however. For instance, the most common NFTs are based on the Ethereum blockchains, and their primary blockchain standards are ERC-721 and ERC-1155. The Ethereum ERC-721 standard first became popular in 2017 with the CryptoKitty game.

ERC-1155 is a more advanced Ethereum standard that allows for the inclusion of multiple fungible and non-fungible items in the same smart contract. You store this data in a smart electronic wallet. Other Ethereum-based standards (all with unique features) include ERC-994, ERC-420, ERC-809, ERC-1201, and ERC-998.

Other smart contract platforms have also developed standards; for example, the Chinese platform Neo has NEP-10 as their equivalent to ERC-721.

Examples of NFTs

NFTs have been increasing in popularity since 2017. CryptoKitty was the first mainstream use of NFTs. However, there were earlier experiments using Colored Coins on the Bitcoin Blockchain, Rare Pepes (tokens based on the Pepe the Frog character), and CryptoPunks (10,000 unique collectible punks.) Trading card games make a natural fit for NFTs, for example, Gods Unchained, whose cards regularly sell in secondary marketplaces.

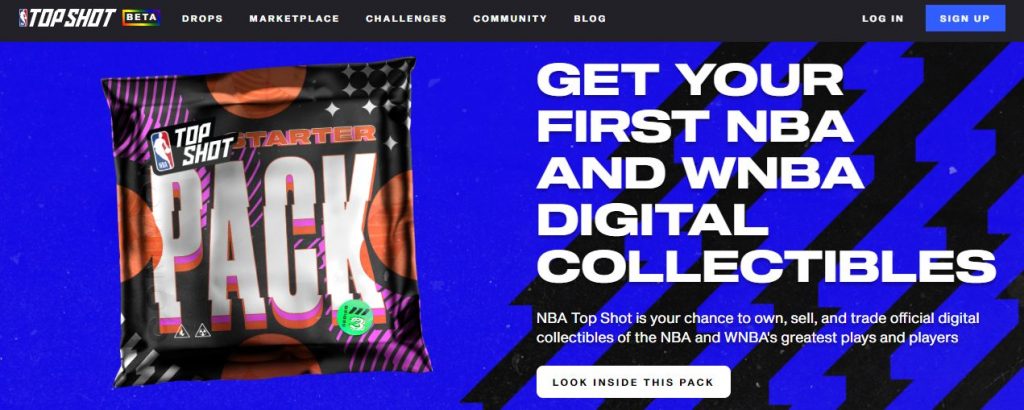

Many NFTs are collectibles, including, for example, sports cards and other rarities. NBA TopShot collects epic NBA moments on cards, minting them on the blockchain in limited supply. They split their cards into Common (10,000+ created), Rare (500-4,999 created), Legendary (50-499 created), and at some point in the future, Platinum Ice Ultimate (only 3 will be created) and Genesis Ultimate (only a single card).

Domain names have become a popular type of NFT. For example, Ethereum Name Service has become a popular way to store all of your addresses and receive any cryptocurrency, token, or NFT. ENS is the most widely integrated blockchain naming standard. You can launch censorship-resistant decentralized websites with ENS.

You will even see NFTs in footwear. The X is more of an artwork than something you would wear, however. The outside of the sneaker features an evolving AI painting.

NFTs in Gaming

There have been digital add-ons in games for years, but they have tended to be localized to individual development companies. However, we are now seeing an increase in NFTs in gaming. For example, Steam has a Community Market where members can sell items to each other for Steam Wallet funds. These are in-game items for games like Counter-Strike: Global Offensive, DOTA, and Rust.

One of the earliest examples of NFTs in gaming was CryptoKitty, which allowed the purchase and subsequent 'breeding' of digital cats. Each of these digital cats was different, and some sold for as high as $200,000.

In Dark Forest, you explore different planets and collect Artifact NFTs on new worlds. You can also win these Artifacts in battles and trade them in decentralized marketplaces.

Source: axieinfinity.com

NFTs in gaming have also allowed gamers access to the metaverse—a vast network of creator-owned spaces and virtual worlds viewed as the future of the Internet. Metaverse gaming includes tradeable and purchasable NFTs that allow gamers to earn as they play. Players of the NFT game Axie Infinity can develop, battle, and trade Axies like Pokémon, only with real dollars involved.

NFTs in Art

Digital art has become particularly popular in recent times. Just as with physical artworks, there is an "original" of any digital artwork, secured by an NFT blockchain, with digital ownership and authenticity. Sure, you will find digital copies of any original artwork (just like you see reproductions of traditional paintings), but only one digital original.

Some of the prices that digital art has reached are staggering. A work by Beeple sold for over $69 million in March 2021.

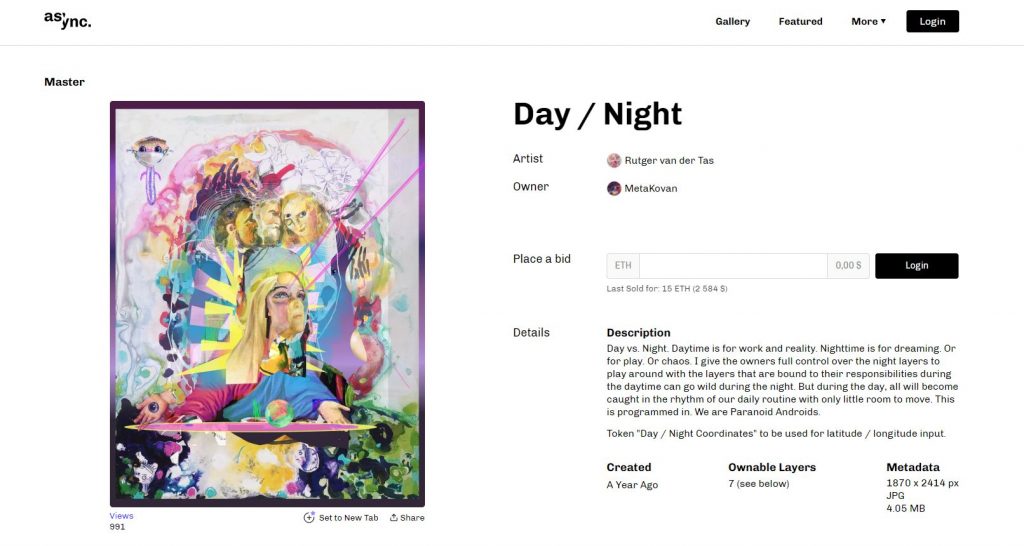

Artists have discovered that there are far more uses for digital art than just a way to verify ownership, however. They can utilize all digital capabilities to create different types of art. They can, for instance, make programmable art that changes depending on the situation. For example, the background may change color if the price goes above a particular bid. Rutger van der Tas has created art that varies depending on whether it is day or night.

Source: async.art

Async Art is a site dedicated to programmable art. Its artists create digital paintings split into layers. Each artwork is a collection of layers and is backed by a unique token that lives on the blockchain. Layers have special parameters set by the artist and influence the overall Master image.

NFTs as Social Tokens

You can now receive NFTs in many different ways, usually as part of a community. Quite a few of these are issued by creators to their supporters, such as for being an early purchaser of their merchandise. Social tokens allow supporters to access exclusive experiences such as meet-and-greets, early access, and exclusive memberships. Some supporters perceive these as investments in the creator’s career. Each token has a value that can increase over time as the creator’s career rise. While social tokens are fungible, social NFTs are unique. This opens the doors to intriguing dimensions, such as the ability of creators to fully control their personal creator economy.

Some of the most popular social NFTs are BAYC and Veefriends. BAYC stands for Bored Ape Yacht Club, a members-only club for Bored Ape owners. To get in, you must own one of the 10,000 Bored Apes NFT where one was sold for over $3 million! Famous and important people like Steph Curry own Bored Ape NFTs and have popped into community events, making BAYC the “place” to be seen.

Source: boredapeyachtclub.com

Another popular social NFT is Veefriends by marketing and business guru Gary Vaynerchuk. Vaynerchuk himself hand-drawn the designs, which sold as NFTs and provided buyers access to mentoring sessions, wine tastings, fishing trips, and the annual Veecon meetup.

As with all other NFTs, social NFTs are unique and backed by the blockchain.

NFTs and DeFi

NFTs are transforming the DeFi world. The two are mutually beneficial technologies opening new possibilities in the financial industry. DeFi relies on NFT’s ability to store value and serve as immutable proof of ownership.

DeFi stands for decentralized finance. It is a type of financial application in cryptocurrency or blockchain. DeFi expands the use of blockchain from simple value transfer to more complex financial uses. DeFi removes the middlemen from transactions.

Most DeFi applications are built on top of Ethereum – the same cryptocurrency platform that introduced NFT standards.

Here are the applications of NFTs in DeFi.

1. Loan Collaterals

The most prominent use of NFTs in DeFi involves using NFTs as collateral for loans. For example, if you bought a rare NFT item in the past, you could use it for a cryptocurrency loan today. This has resulted in NFT lending fueling the growth of DeFi by as much as $49 billion in 2021. Platforms accepting NFTs as collaterals are TrustNFT, PawnFi, NFTfi, Genesis, and Arcade.

2. Fractional Ownership

You can also buy shares in some NFTs, rather than buying them outright. This means you can be a part-owner of an expensive NFT, for example, a one-off piece of digital art. You can even trade some of these shares. Fractional.art allows users to divide NFTs and generate ERC20-compliant shares. This helps expensive NFTs become more liquid, reducing entry fees and enabling more access.

3. Insurance Management

DeFi and NFT are also expected to switch things up in the world of insurance management. Insurance policies for both crypto assets and traditional insurance plans can be converted to NFTs that don’t have expiry dates. This means insurance products can be purchased, put up for sale, or transferred without you having to go through the taxing renewal process every single time. CoverCompared combines DeFi and NFTs to reduce insurance policy prices and offer premium-quality insurance products. It aims to work with various multinational insurance providers to expand its offers.

4. Debt Management

NFT and DeFi can help reduce human errors and redundant processes associated with managing and tracking the finances of large groups of people. When approvals and various other processes are automated using smart contracts, things run smoothly and result in better transparency. If a borrower uses an NFT as collateral and can’t repay the loan, the NFT is automatically transferred without the need for any legal action.

Final Thoughts

NFTs are speculative digital assets that have captured the interest of crypto enthusiasts and collectors alike. It has demonstrated its various uses and possibilities even as some people remain skeptical of its value. While some critics argue that NFTs are a fad, it’s evident that many don’t agree. DappRadar has seen NFT sales rise from around $100 million in 2020 to $25 billion in 2021.

With NFTs like the Gucci Ghost selling for an average of $2,178 and the Beeple video selling for $6 million, NFTs seem like they’re here to stay. NFTs are as volatile as cryptocurrencies, but for those who play it right, the opportunities are endless. Creators can mint NFTs and sell them to avid fans and earn royalties for each purchase. Audiences can support their favorite creators by purchasing an NFT either to trade later or to keep as a souvenir.

Whatever your beliefs about NFTs are, only time will tell how this trend will pan out. For now, it’s an emerging technology that’s exciting, lucrative, and financially promising.

Frequently Asked Questions

What are NFTs and how do they work?

NFTs (non-fungible tokens) are unique tokens that store valuable information. They are digital assets representing Internet collectibles. Many believe that NFTs are the digital answer to collectibles since they can prove a person’s ownership of a digital file.

Most NFTs are built on the Ethereum blockchain. Their value follows market and demand just like physical art forms. Examples of NFTs include digital art, domain names, games, and even virtual sneakers.

Why do people buy NFTs?

People buy NFTs to collect them as digital art. NFTs guarantee that a person is the owner of a digital file.

The majority of NFTs sold are used as digital content and gaming items. With developments in DeFi, NFTs can be used as loan collateral.

Can you lose money on NFTs?

NFT creators can earn serious money in minting NFTs, but you should keep in mind the fees associated with it. Minting NFTs isn’t cheap, and depending on the market, it’s possible to lose more than you can earn.

The same is true for speculative buyers. NFTs are digital investments, and like other investment types, it carries certain risks that can cause investors to lose money.