Advertising disclosure:

Our partners compensate us. This may influence which products or services we review (also where and how those products appear on the site), this in no way affects our recommendations or the advice we offer. Our reviews are based on years of experience and countless hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Blockchain has disrupted the way industries work these past years. When it comes to virtual assets, around 13% of Americans own at least one cryptocurrency. This is expected to rise further to 19% by the end of the year. Regardless of age, individuals are recognizing the value of virtual assets.

The finance industry has evolved at a rapid pace thanks to blockchain. Crypto investors are no longer seeing cryptocurrency as just an investment asset; they are open to using these coins and tokens to pay for goods and services. Because there is a sizable community across industries that see crypto as not just an asset but as an investment in a structure that no longer relies on brick-and-mortar banks, there is a push to move toward decentralized finance (DeFi).

Most Trusted Blockchain Payment Systems:

Blockchain in Finance

Blockchain is a distributed database that contains a list of ordered records, called blocks. The blocks serve as time-stamped digital records of any transaction or data exchange. The ledger of records is distributed in real-time across a network of computers. It’s a more secure form of transaction, as each block has a cryptographic hash, much like a unique ID.

Every time a new transaction is added to the record, a new block is added, with the previous block’s hash connected to the new block’s hash, and so forth. This ultimately creates a secure network validated by all the network nodes involved. Each block can’t be altered and, therefore, provide a transparent record of all transactions. Blockchain has become a differentiator in the finance industry, as it offers crucial advantages in security and transparency that may be lacking in traditional banking systems.

Why Choose Blockchain Payment Systems

Blockchain is expected to grow and complement, if not totally replace, traditional banking systems. More than 20 countries have researched creating a national cryptocurrency. And traditional banks seem to be looking into adopting crypto payments as well. Around 90% of U.S. and European banks have examined blockchain since 2018.

Blockchain payment systems enable cryptocurrency use for payments. As crypto uses blockchain technology, all transactions are facilitated, processed, and verified under a distributed ledger system. Such payment solutions give individuals and businesses a quick, verifiable, and secure avenue to make transactions.

Companies, for instance, benefit from blockchain, as it provides a highly traceable and verified record. Moreover, the forms of payment are much more efficient than traditional financial institutions, where there’s less automation in verifying accounts. With blockchain, smart contracts and crypto payments can be completed across country borders much faster and with integral security.

Best Blockchain Payment Systems

There are several blockchain payment gateways currently available. Let’s have a look at some of the top options, each with their respective pros and cons:

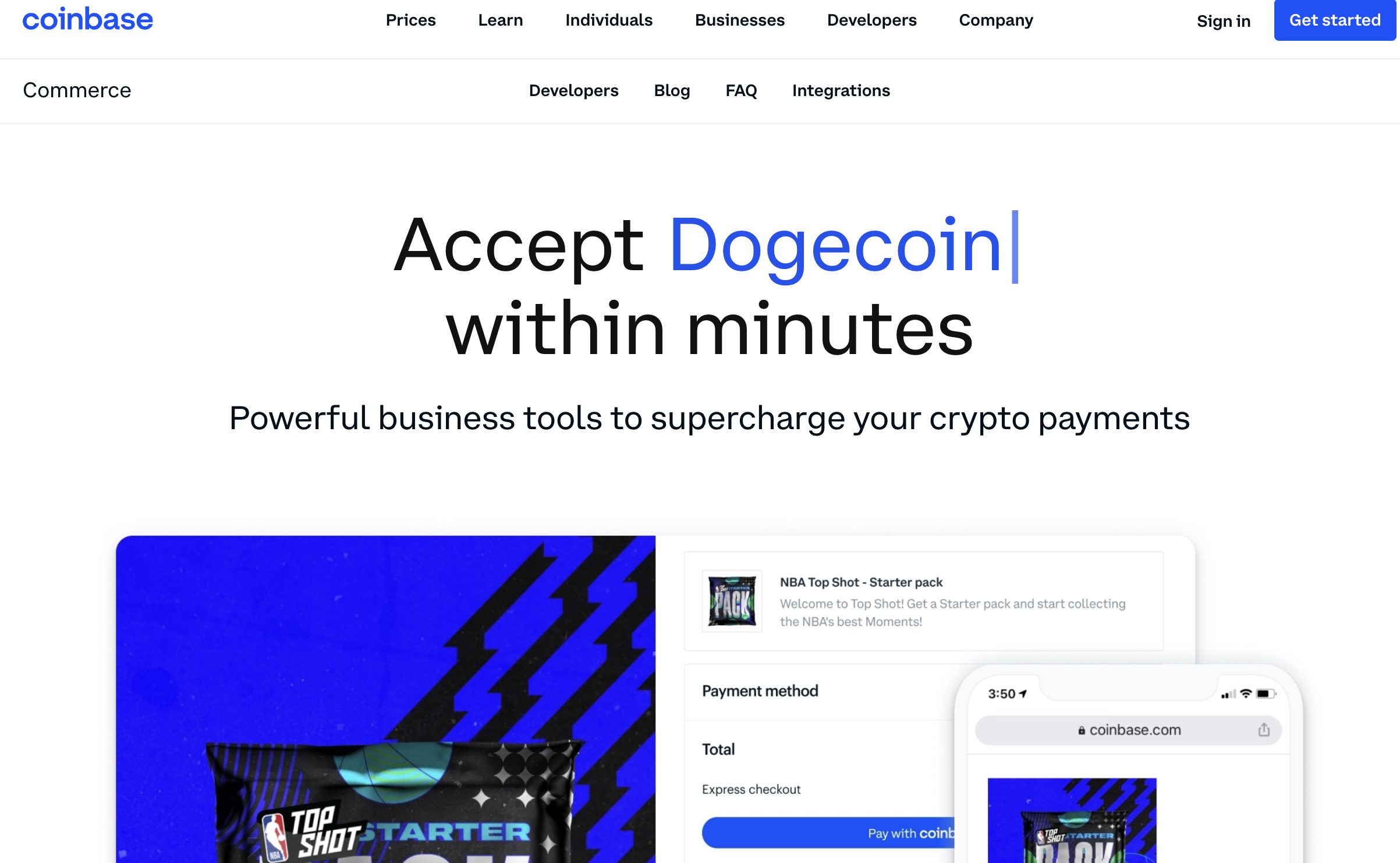

1. Coinbase Commerce

Coinbase is the biggest currency exchange available to the U.S. market. It’s a trusted system, as you can transact with crypto using your local fiat currency. In addition, Coinbase offers a gateway that merchants can integrate with Shopify and WooCommerce.

Coinbase Commerce has two types of plans: Self-Managed and Coinbase Managed. For the Self-Managed account, you can set up the account quickly using a valid email address. You’ll be able to hold the private keys for the crypto that you are paid with.

Meanwhile, the Coinbase Managed account means the platform automatically settles crypto or fiat transactions for you. You don’t have to manually deal with currency conversions whenever you transact using the account. Coinbase Managed plan funds are also guaranteed in case of fraud or theft.

There’s a 1% transaction fee for both plans. Coinbase allows payment in the following coins:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- USD Coin (USDC)

- DAI

The main advantages of Coinbase Commerce include its integration with two eCommerce platforms and the ease of conversion from crypto to fiat and vice versa. Of course, while Coinbase is a trusted platform, you have to choose which of their plans will have the most balanced perks and trade-offs for your needs.

2. BitPay

BitPay is another longstanding payment platform that has been around for a decade. It’s one of the most established blockchain payment systems that support not only retail payments but also payouts and billing for businesses.

BitPay uses a simple QR code invoicing for retail payments. There is a flat 1% fee on every transaction that takes place. BitPay allows businesses to collate all sales per day and deposit them in the form of fiat or crypto coins straight in a bank account or the BitPay wallet. The process ensures that the exchange rate is locked in at the time of the sale.

BitPay can integrate multiple wallets and currencies in one location and ensures crypto payments are easily transferred into traditional bank accounts. BitPay accepts a wide range of crypto, including:

- Binance USD

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- DAI

- Dogecoin (DOGE)

- Ethereum (ETH)

- Gemini Dollars (GUSD)

- Litecoin (LTC)

- Ripple (XRP)

- USD Coin (USDC)

Payouts are available in fiat, Bitcoin, Bitcoin Cash, Gemini Dollars, and more. The convenience of BitPay’s transaction integrations, multiple wallet setup, and payment processing make it a popular choice for businesses that want to leverage blockchain payment solutions. And as crypto is not backed by any government regulatory board, BitPay provides extra security (e.g., two-factor authentication, multi-signature wallet, data encryption) to make sure all crypto funds and transactions are secure.

BitPay can insulate merchants from volatility, but that could also mean it may curb the value of a transaction because it locks in the exchange rate at the time of the sale. The platform also requires minimum balances before any payout can be made.

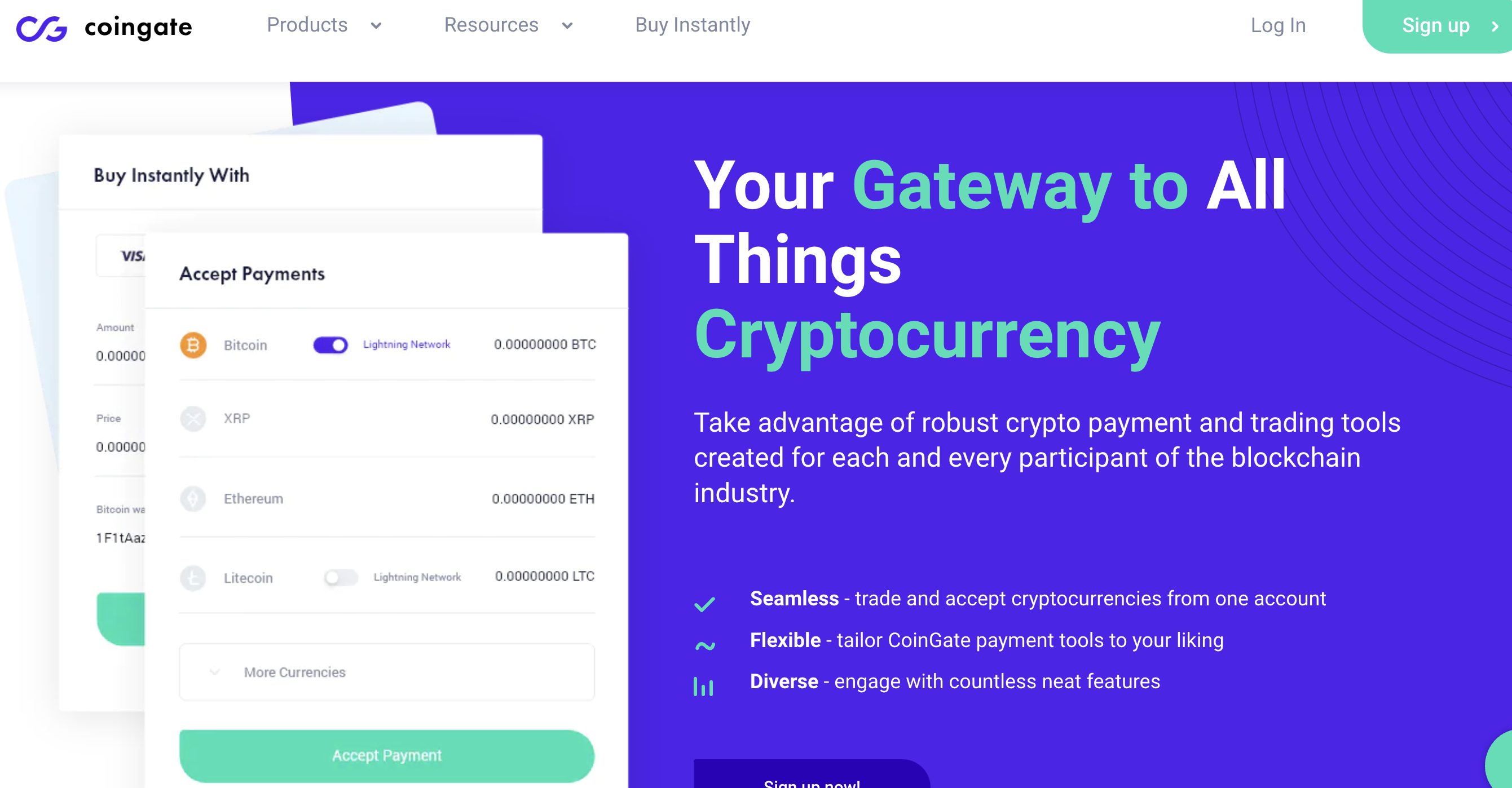

3. CoinGate

CoinGate is a Lithuanian-based company that provides blockchain payment solutions for enterprises and individuals worldwide. Originally built to support BTC, the company now sets itself apart by offering a gateway that processes Chainlink, Cardano, and Stellar, among others. In short, you’re not limited to the usual stablecoins since there are more crypto options on this platform.

CoinGate integrates with sales processes via a plugin or module (e.g., WooCommerce and Magento). The platform can issue invoices through emails or links. The payouts can be in crypto form or, if the account holder wants, can be converted to fiat (such as U.S. dollars or European currency). Crypto-to-crypto exchange is also allowed.

With as many as 50 cryptocurrencies supported, CoinGate is a mature platform that can widen your crypto options. There’s a 1% fee per transaction on the system. The platform offers buying and selling options, invoicing, payments to goods and services, and storing of assets via wallet. Their wallet management, exchange management, and API are accessible through websites and mobile apps. Transactions are secure with the system’s high-level protection against hacks.

The only drawback to CoinGate is that users aren’t able to deposit cryptocurrencies. There’s also no CoinGate wallet available, which means you have to have an existing wallet and integrate that into their system.

4. Veem

Veem is a blockchain-based platform based in San Francisco. The company works with fiat currency for both domestic and international payments. It’s much like a traditional wiring system but better because of its added features.

The platform leverages blockchain technology, and it offers businesses handy tools for sending, receiving, and reconciling business payments securely. The payment system provides a more streamlined integration and a more transparent history of all incoming and outgoing payments.

Veem offers cost-effective options for local and global payments. With Local pricing, you can sign up for free to secure your transactions within the U.S. Meanwhile, with Cross Border, users can send money, issue digital invoices, and track payments in over 100 countries worldwide.

Veem’s big advantage is it makes it easy for businesses to set up a secure blockchain payment and invoicing system. As for the drawbacks, each transaction has a designated fee, and it can be hard to estimate your total cost at any given time. Credit card transactions have a 2.9% fee, the instant deposit is 1%, and international payments have a $29 fee. Your business may need to spend extra time analyzing costs relating to transactions under Veem’s system.

5. RippleNet

Ripple is a San Francisco-based company that uses blockchain to let customers send money and pay for goods and services worldwide. Its RippleNet system allows for quick and transparent processing of payments and facilitates lower capital amounts for cross-border transactions. RippleNet is currently used by over 175 banks and commercial enterprises.

Businesses can buy and sell, issue, and settle digital assets in real-time through the platform. RippleNet’s features include automated notifications, debit and credit card processing, data tracking, data security, and more. Your movements are easily monitored in the activity dashboard. The platform also comes with an API for easy integration with your existing sales tools.

RippleNet is a good choice for businesses that want a blockchain-based payment system when dealing with global transactions. The only considerations with RippleNet are the transaction costs and delays in some cases while using a VPN.

What to Look for in a Blockchain Payment System

Blockchain payment systems can go beyond peer-to-peer transactions. With the wide range of options for blockchain finance platforms, keep in mind these features to help you decide which one is the best for your business:

-

Integration

The main goal of a blockchain payment system is for customers and peers to have an intuitive and seamless experience. You would want a platform that is known to be user-friendly, has fast processing, and prioritizes secure and protected transactions. Pick a payment system that works well with your company’s existing tools and technologies, so you can offer it in conjunction with what already exists in your ecosystem.

-

Volatility Protection

Cryptocurrencies tend to be more volatile than fiat currency. It’s the nature of the technology, as it is free from the regulations that governments place on traditional financial assets. Considering this fact, the price you are working with for each transaction could change a minute later. Your business will then benefit from a payment system that guarantees a locked-in value from the time of your sale. Understandably, not every firm would want this feature. But for most, it is a way to safeguard each transaction from potential losses.

-

Currency Support

Blockchain payment systems should automatically work with popular cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. You should also consider payment systems with a more extensive list of supported cryptocurrencies. Gateways that are able to support more coins can give you the capability to accommodate your customers’ preferences.

-

Cost

As we’ve outlined in our top 5 blockchain payment systems, the standard fee for most transactions is around 1%. However, this does not apply to all platforms. Providers may charge additional fees when payout or conversion is required. There are also systems that have other network or operational costs that are separate from your transaction fees. You would want to keep in mind the features you want a blockchain payment gateway to have and decide which capabilities are the most worthwhile to spend on.

-

Reputation

The cryptocurrency landscape has its fair share of idealists and fraudulent actors. Many will still take advantage of the lack of regulation, which means your assets and your very business operation may be vulnerable when there are phishing or hacking attacks. Therefore, it’s important to conduct due diligence when selecting which blockchain payment system has the security and authentication features that can provide a high level of protection for your transactions.

Final Thoughts

Blockchain payment systems have paved the way for faster and easier crypto payments and transactions. As businesses leverage blockchain-based payment systems, they can experience quicker cross-border transactions as well as more transparency. There are still adjustments and improvements that can be made, especially as the technology matures, but we have outlined five solid options you can use for your business operations. Now it’s just a matter of selecting the provider that can offer you the features and amount of exposure to crypto that your business can benefit from.

Frequently Asked Questions

What payment methods does blockchain accept?

Most blockchain payment systems allow you to select your payment method: debit card, card card or bank transfer. U.S. users can also do instant ACH transfer.

Which banks use blockchain?

HSBC is using R3 blockchain platform to enable their Digital Vault. The Digital Vault is a custody blockchain platform that stores digital assets. The blockchain technology helps lower the cost of their custodial services.

What is an example of a blockchain transaction?

An example of a blockchain transaction includes cryptocurrencies. The financial transactions are based on blockchain technology. It is used in currency and payments.

How do I make a payment on blockchain?

Most blockchain payment systems allow you to select your payment method to make a payment: debit card, card card or bank transfer. You can also use cryptocurrency or develop a cryptocurrency.