On March 11, 2021, an artwork sold for a record-breaking $69 million at a Christie’s auction. No, it’s not a piece by the Old Masters, big names in the any art movement, or contemporary darlings Damien Hirst and Jeff Koons. What makes this piece different from the usual offerings of this centuries-old auction house is it’s a digital piece, an NFT created by Mike Winkelmann, otherwise known as Beeple.

The auction house considers it to be the “first purely digital artwork” they’ve ever offered, and there’s currently no sign of stopping. In fact, Christie’s will be testing the waters when it comes to demand for digital art with new NFT offerings.

That’s just one way the advent of NFTs and blockchain technology has already begun to redefine the creator economy.

NFTs, or non-fungible tokens, have become a buzzword of late. With celebrities, content creators, artists, and brands, such as Grimes, Pringles, and Charmin, jumping on the bandwagon, public interest around this digital phenomenon has greatly increased over the past few months. But along with its rise in popularity comes a lot of questions and speculations on their possible implications on the creator economy.

What are NFTs anyway, and how are they making such a big impact on the digital front? In this article, we’re taking a deep dive into NFTs and what they can possibly spell for creators, businesses, and marketing.

NFTs and Their Role in the Changing Digital Economy:

What Are NFTs?

If you’re familiar with cryptocurrency, then you might have already heard of non-fungible tokens.

A non-fungible token is a unique digital asset similar to cryptocurrency that’s managed on a blockchain. While purely digital, NFTs are seen as a value-holding investment. The NFTs’ USP is that they’re unique. Unlike standard cryptocurrency such as Bitcoin or Ethereum, which are fungible, each NFT is unique and can’t be exchanged or replaced with something similar. While some NFTs may have some similarities, each one is inherently unique.

Simply put, think of NFTs as trading cards. If you have, say, a Dalek card and trade it for another NFT, you’re probably going to get something like a 1952 Topps Mickey Mantle for it.

NFTs can be anything, as long as they’re digital. It can be a work of art, music, or video clips, among other iterations. They have a one-up over cryptocurrency as they store extra information that expands their capabilities.

“But what makes them so special?” you ask. Anyone can download the same content, right? Technically, yes. But what sets NFTs apart is when you purchase an NFT, you gain ownership of it. Think of it in terms of collecting antiques or artworks. While there’s an abundance of prints available for Van Gogh’s Starry Night, there’s only ever going to be one original that’s in the possession of the current owner.

According to Peter Yang’s informal survey, a majority of individuals who bought NFTs did so to make money. Some bought NFTs to show their support for the artist, while others were seeking to add to their collection.

The History of NFTs and Their Rise to Popularity

So, who’s responsible for all this NFT hoopla? Andrew Steinwold has crafted a comprehensive history of NFTs, starting with their predecessor, Colored Coins.

Colored Coins

Arguably, NFTs started as early as 2012-2013, with the inception of Colored Coins (CC). CCs are derived from Bitcoins and are viewed as small denominations. CC use cases include property, coupons, and subscriptions. The advent of CCs signaled the skyrocketing of Bitcoin’s capabilities, eventually paving the way for Counterparty.

Counterparty

Source: counterparty.io

Counterparty is a P2P platform that enabled creators to create custom named assets that can be exchanged. It also allowed creators to come up with their own digital tokens.

Spells of Genesis

To combat the spread of counterfeit versions of character cards, Spells of Genesis creators came up with a trading card game that utilized blockchain technology. This allowed players to determine the authenticity of the cards.

The Rise of Rare Pepes

Rare Pepes (RP) proliferated on platforms such as Counterparty and Ethereum. Rare Pepe is a meme with an intense following that warranted the creation of a Rare Pepe Directory where experts certify the rarity of a Rare Pepe. The information derived would then be given to Pepe wallets, which means that when an RP appears in any of these wallets, they’re certified rare.

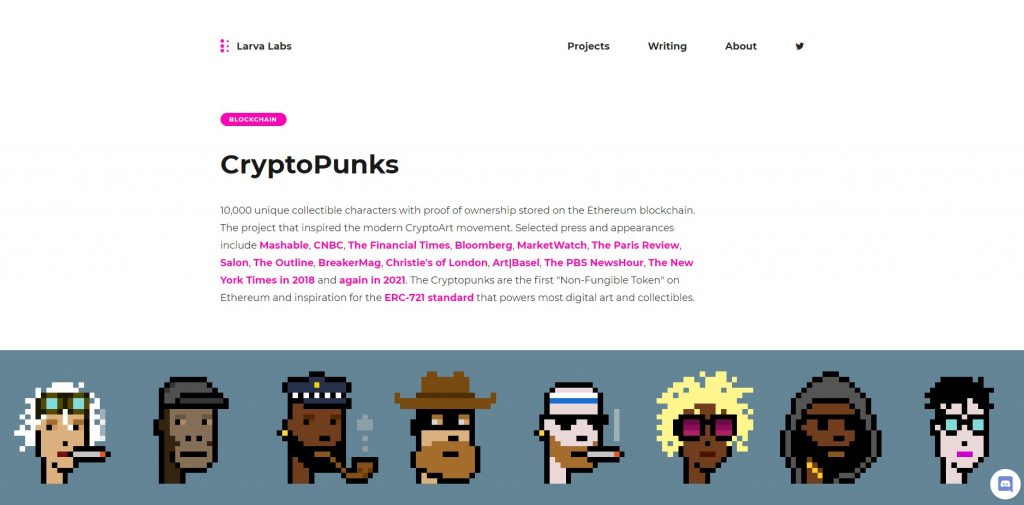

CryptoPunks

Source: larvalabs.com

In 2017, Matt Hall and John Watkinson of Larva Labs released CryptoPunks, a series of 10,000 24 x 24 bit images with Ethereum as their base. While they began as free, prices have since skyrocketed, even reaching a lofty $7.57 million.

CryptoKitties

After CryptoPunks came CryptoKitties. It’s a game, kind of like Tamagotchi, but it’s virtual and blockchain-based. Here, you can buy and sell CryptoKitties (CK), play games, and even breed cats to unlock traits. With the advent of CK, NFTs were given a more widespread platform that has spread to a greater public consciousness.

The Current State of NFTs

NFTs have taken the world by storm, and it’s predicted that they’ll continue to grow in popularity and use. For companies, not participating in these digital trends may mean missing out on some of the benefits that come with their exponential growth.

How Do They Work?

So, how do NFTs work? Do they work like standard cryptocurrencies?

NFTs are a part of the Ethereum blockchain. Blockchain groups, as their name suggests, are a database where data is stored in groups or blocks. These blocks are held, or chained, together digitally. Think of blockchain this way: when one block is up to full capacity, another block that’s chained to the original is added to the chain.

How does this apply to NFTs? As previously discussed, NFTs are unique and store extra information. When an NFT is sold, that record is added to the blockchain. This act ensures that the NFT history is intact and has a secure ownership. Plus, NFTs are backed digital currencies, kind of like cryptocurrencies. This makes subjects them to a unique of set of standards.

So, why not go the easy route and just download a copy of an NFT the old-fashioned way? The act of right-clicking and saving an image won’t attribute it with the necessary bits of information that has made it a part of a blockchain system in the first place. Given that each NFT is unique, that uniqueness gives them a corresponding, distinct value. Note that this value can change, depending on factors such as its perceived scarcity and the demand for it.

How Are NFTs Redefining the Creator Economy?

The creator economy was preceded by the attention economy, a model wherein the most valuable commodity was the audience’s attention, which was then considered a valuable and scarce resource. This model isn’t a novel concept. In fact, it’s been around for quite some time. The term was coined by Nobel laureate Herbert A. Simon, and the concept was further explored by Michael Goldhaber in 1997, who wrote that the economy would be shifting from a material-based model to an attention-focused one.

In this model, what the audience consumed was primarily dictated by big companies such as Google, Apple, and Facebook. That well-placed ad that pops up as a side bar while you’re reading an article? That’s only a small part of the whole. And, in this model, your attention ultimately means revenue for these companies. What seems to be a “normal” part of our daily lives has some negative repercussions, including passive consumption, the constant “need” to use our devices, and what’s been dubbed “mindless scrolling.”

A paradigm shift then led the attention economy to pave the way for the creator economy. In this model, creators, who are everyday people like us, have taken control of various online platforms to engage with their audience. While not an entirely new concept, this model has greatly democratized how content is made and shared, in effect decentralizing big name platforms. It has also enabled creators to build off their passions and for the audience to have more autonomy in choosing what they’d actually like to consume.

Given its unique setup, the creator economy has enabled individuals to create digital content that utilizes blockchain-based technology, which in the process can alter what the financial landscape would look like for the creators involved. They’ve made it possible for creators to earn millions from a single piece of work alone.

Creators are looking into ways of utilizing NFTs to share unique, paid experiences and to engage with their fans, according to Sam Blake. NFTs put a prime on ownership, the idea of which renders a particular item to be more valuable simply because it’s owned. Banking on the innate human perception that owning things is a value in and of itself, NFTs enable fans to associate experience with value.

Creating an NFT

NFTs further democratize content creation. They give creators full freedom over their content and may be an avenue to gain bigger earnings. Peter Yang posits that, with NFTs, you won’t have to deal with intermediaries who can take control of your content rights, as well as your visibility and a percentage of your earnings.

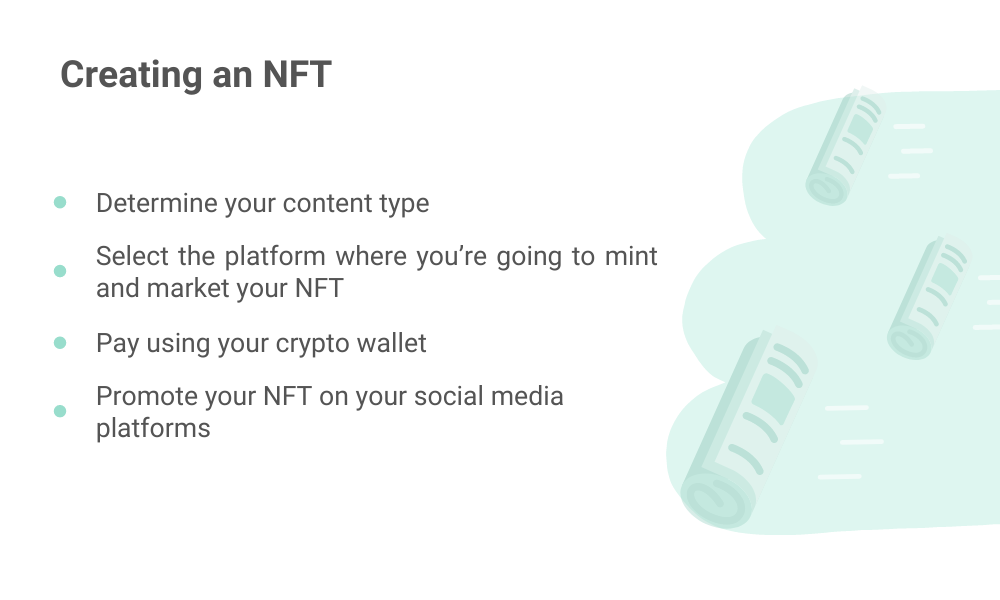

He also shares a pretty straightforward approach to creating NFTs. In the same article, he proposes four steps:

- Determine your content type

Do you want to create a video clip, a short audio, a GIF, or a collage? The great thing about NFTs is that they’re not confined to “tangible” pieces. They can also be made for domain names and even virtual game items, as per Yang.

- Select the platform where you’re going to mint (aka create) and market your NFT

Would you opt for self-service platforms such as Rarible and OpenSea, or would you want to use curated platforms such as SuperRare? The former category is a more accessible avenue, as it lets practically anyone create NFTs. The latter can only be accessed by approved creators.

- Pay using your crypto wallet

Creating NFTs come with a relatively hefty price, which you can pay using a cryptocurrency.

- Promote your NFT on your social media platforms

Once you’ve minted your NFT, you can then start promoting it on your social media channels. Popular avenues include Twitter, Reddit, and Instagram.

One of the best things about NFTs is that you can make an unlimited number of them. The catch is that you need to determine how many editions of a particular NFT you’re going to issue, according to Yang. Do you want to go the 1-of-1 route, where there’s only one original piece, or would you rather release several limited-edition copies of one particular NFT?

Let’s Mint an NFT

Minting is the process of creating an NFT. While Yang’s outline seems pretty straightforward, there’s more to it than meets the eye. In our article NFT Guide for Creators – How to Mint and More, we’ve detailed a more comprehensive outline of what it takes to mint your very own NFT.

Who’d Spend Money on NFTs?

A variety of individuals, from collectors to those seeking to earn higher profits. Purchase of NFTs isn’t isolated to what Yang calls “super fans,” whose primary motivation for NFT purchase is to support the creator. But NFTs give these super fans the opportunity to earn, according to Yang. He gives this particular scenario:

Imagine you’re a fan of a yet unknown artist and you’ve paid a sizeable amount for an NFT from them. Fast forward to a few years later, this artist becomes famous. Of course, there would be an increased demand for goods associated with the artist. This then gives you an opportunity to sell that artist’s NFT at a much higher price.

Where Can You Buy NFTs?

NFT marketplaces abound. If you’ve always wanted to dip your toes into NFT territory, popular marketplaces you can check out include OpenSea, Nifty Gateway, Rarible, and SuperRare. Each platform has its own set of pros, cons, and features. We’ve discussed 11 of the most popular NFT marketplaces in the article Top NFT Marketplaces for Creators to Sell Non-Fungible Tokens.

NFTs and Businesses

Brands can leverage NFTs, not just artists and creators. While still in their infancy, NFTs pose a lot of potential that can have real marketing value for brands.

The point here is that NFTs have gone beyond just being a new digital trend and have transformed into a commodity that has actual value. Many big name brands, from Charmin to Taco Bell, have utilized NFTs in their marketing campaigns, innovating by incorporating them into their respective campaigns. Taco Bell sold NFT Taco GIFs, a newspaper column sold for hundreds of thousands of dollars, and Pringles unveiled a “CryptoCrisp” flavor—with NFTs, the possibility for marketing is virtually endless.

According to Amrita Khalid, while NFTs are currently being viewed as big business, there’s always two sides to a story. On the one hand, finance experts are advising investors to observe caution when dealing with NFTs as the market may soon burst, given the continuous influx of new NFTs. On the other hand, there are those who posit that these can have a number of marketing applications.

Richard Yao suggests that NFTs are ideal for creating a perception of scarcity, which is useful for establishing a purported value of certain digital goods. He also suggests that NFTs have the potential of unlocking new monetization models for these digital goods, as these can largely decentralize the way with which digital media is created, distributed, and monetized. One other use case for NFTs in marketing is that they promote the need for authenticating access to digital experiences. Given that access to NFTs has been “tokenized,” per Yao, this then becomes a commodity that fans can trade with each other. Plus, NFTs can be a new vehicle that allows brands to market themselves.

Meanwhile, Neil Patel shares a number of ways brands can utilize NFTs to their advantage. According to him, businesses can use NFTs to craft a unique brand experience. These can also be used to foster interaction, boost engagement, and generate interest in what you’re offering. The bottom line, according to Patel, is that NFTs can be used to increase conversion rates, which translates to increased revenue.

While the future of NFTs seems promising, there are some potential risks and legitimate concerns that you should be aware of. One such risk is that cryptocurrencies, like Ethereum, are volatile. You can view NFTs as an investment, and like any other investment, they come with their own set of risks.

Concerns Surrounding NFTs

There are a number of concerns surrounding NFTs. One of the more pressing ones is their environmental impact, owing to the amount of energy they use. Legal issues are also a cause for concern, particularly when it comes to data storage, royalties, and data protection laws.

NFTs are still at a relatively early stage, but prospects surrounding it appear to be very good so far. Those who have already engaged in the creation and marketing of NFTs have greatly benefited from them and continue to do so, with more and more agencies and companies becoming more open to accommodating this new technology.